Recognizing the Refine and Benefits of Bankruptcy Discharge Singapore

Recognizing the Refine and Benefits of Bankruptcy Discharge Singapore

Blog Article

Comprehending the Refine of Bankruptcy Discharge and Why Seeking Professional Support Is Important for Your Financial Future

Browsing the intricacies of personal bankruptcy discharge can be a challenging task for individuals facing monetary turmoil. As you embark on this important economic course, the importance of expert advice can not be overemphasized, using a sign of hope among the obstacles that exist ahead.

Importance of Personal Bankruptcy Discharge Process

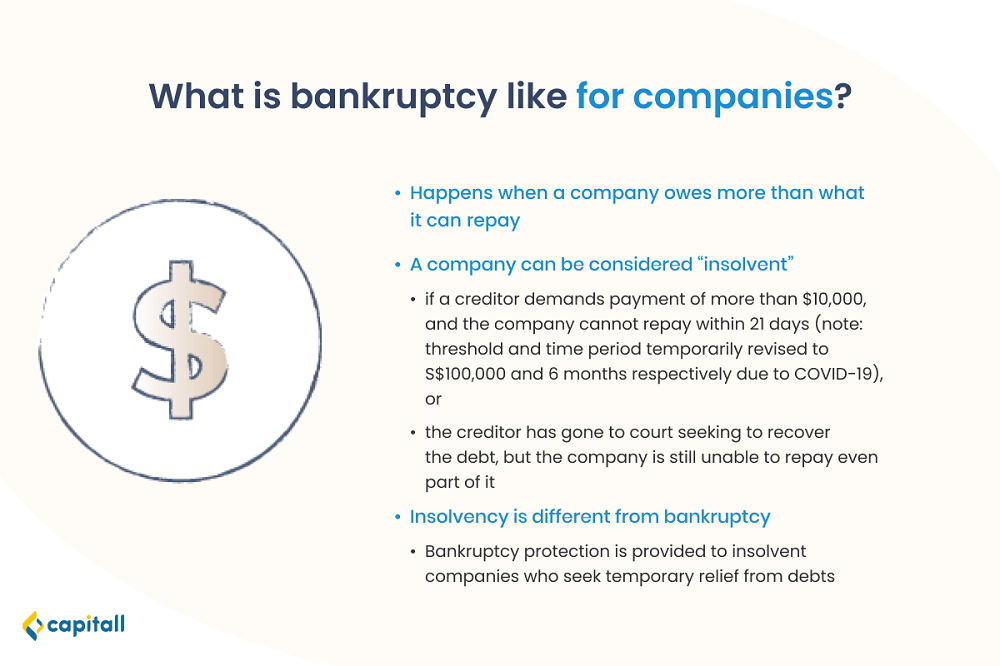

The relevance of the personal bankruptcy discharge procedure can not be understated for individuals seeking monetary relief and a clean slate after encountering impossible debt burdens. This critical point of the insolvency process marks the factor at which the borrower is launched from personal responsibility for sure sorts of debts, providing them with a tidy slate to rebuild their monetary stability. The giving of a personal bankruptcy discharge is an effective tool that allows people to progress without the weight of previous monetary responsibilities dragging them down.

Furthermore, the personal bankruptcy discharge procedure supplies a sense of closure and finality to the overwhelming and often difficult experience of declaring for personal bankruptcy. It functions as a beacon of hope for debtors that have been facing financial chaos, supplying them an opportunity to damage devoid of the irons of debt and rebound. Looking for expert assistance throughout this procedure is vital to guarantee that all essential steps are required to get a successful discharge and lead the way for a brighter financial future.

Legal Requirements for Discharge

Navigating the personal bankruptcy discharge procedure successfully depends upon understanding and satisfying the details legal needs stated for obtaining relief from particular financial obligations. To receive a discharge, people should stick to the laws outlined in the Bankruptcy Code. One vital requirement is completing a credit therapy course from an authorized agency within 180 days prior to applying for personal bankruptcy. Additionally, borrowers have to precisely reveal their monetary scenario by providing detailed info concerning their revenue, responsibilities, assets, and expenditures. Failing to disclose all appropriate financial details can result in the rejection of a discharge. In addition, borrowers are obligated to participate in a conference of lenders, also referred to as a 341 conference, where they might be examined under oath regarding their insolvency request.

Satisfying these legal demands shows a borrower's commitment to the bankruptcy procedure and increases the chance of an effective discharge. Seeking assistance from an insolvency lawyer can help people browse these requirements and guarantee they accomplish all essential responsibilities for a smooth discharge procedure.

Function of Specialist Assistance

In the complex landscape of insolvency proceedings, looking for expert support contributes in guaranteeing a comprehensive understanding of the complexities entailed. Bankruptcy legislations are complex and can differ depending upon the kind of bankruptcy filing. A qualified insolvency lawyer or financial consultant can supply skilled insight into your particular scenario, leading you with the process with clarity and precision.

Specialist guidance is necessary in browsing the lawful requirements for bankruptcy discharge. Attorneys focusing on insolvency law have the knowledge and experience to help you follow all the essential paperwork, deadlines, and court looks. They can likewise advise you on the very best program of action to require to accomplish a successful discharge.

Furthermore, seeking specialist guidance can assist you prevent pricey errors that might endanger your possibilities of a successful bankruptcy discharge. bankruptcy discharge singapore. By having an educated specialist on your side, you can make enlightened choices my latest blog post that will favorably affect your economic future and establish you on the path to a fresh start

Financial Influence of Discharge

Looking for specialist guidance when navigating the financial effect of discharge in bankruptcy proceedings is critical for making well-informed choices. The discharge of financial debts in personal bankruptcy can have substantial ramifications on a person's economic circumstance. Understanding exactly how different kinds of debts are dealt with post-discharge is crucial for planning one's economic future successfully.

One secret facet of the economic impact of discharge is the difference in between non-dischargeable and dischargeable financial obligations. Dischargeable financial debts, such as bank card balances or clinical expenses, can be Web Site eliminated through bankruptcy, offering individuals with a clean slate. On the other hand, non-dischargeable financial obligations, like student finances or particular tax responsibilities, will remain even after the insolvency procedure is completed.

Furthermore, the discharge of debts can influence an individual's credit report and capacity to gain access to credit in the future (bankruptcy discharge singapore). It is critical to deal with a financial consultant or insolvency attorney to create a strategy for reconstructing credit history post-discharge and ensuring long-lasting economic security. By seeking professional assistance, people can browse the complicated monetary effects of bankruptcy discharge with confidence and clarity

Preparation for Post-Bankruptcy Success

Reliable preparation for success after insolvency includes establishing a tactical monetary roadmap. It is essential to focus on expenditures, get rid of unneeded costs, and focus on building an emergency situation fund to avoid future economic problems.

In addition, post-bankruptcy success planning ought to consist of an emphasis on credit report repair work. Checking credit scores records on a regular basis, challenging inaccuracies, and making prompt repayments on any kind of continuing to be financial obligations are vital actions in boosting credit rating ratings. Rebuilding credit history will open opportunities for acquiring car loans, home loans, and credit rating cards with better terms in the future.

Moreover, seeking expert monetary advice during the post-bankruptcy stage can offer valuable understandings and support in making audio financial choices. Financial experts can provide customized strategies for restoring credit scores, taking care of financial debt, and achieving lasting monetary security. sites By complying with a well-thought-out post-bankruptcy success strategy and seeking professional assistance when needed, people can lay a solid foundation for a secure economic future.

Final Thought

Looking for specialist assistance when navigating the economic influence of discharge in insolvency proceedings is essential for making educated decisions. It is critical to function with an economic consultant or bankruptcy lawyer to develop an approach for reconstructing credit scores post-discharge and making sure lasting economic security. By looking for specialist support, people can browse the intricate economic ramifications of personal bankruptcy discharge with self-confidence and clarity.

Report this page